The Center for Analytical Finance (CAFIN) seeks to understand and improve the working of the financial sector, and financial markets in particular, in order to reduce the chances of another major financial crisis in the near future. Further, CAFIN researchers seek to improve the day-to-day efficiency of financial markets by reducing wasted resources and improving allocations of financial assets.

On March 13 and 14, CAFIN members and UC Santa Cruz Economics Professors Dan Friedman, Eric Aldrich and Kristian Lopez Vargas hosted a workshop on market design and high-frequency trading (HFT), sponsored by CAFIN. HFT arguably wastes resources by demanding expensive telecommunication infrastructure that provides some traders with minuscule time advantages over others. Some researchers argue that this infrastructure enhances market liquidity and price discovery, but others say that those benefits (if they exist at all) are overshadowed by the multi-billion dollar infrastructure costs of such infrastructure. Some observers also question the fairness of HFT given the way financial markets are currently structured.

The recent workshop is part of a larger research project by the three CAFIN members. The project compares the efficiency and fairness of the current financial market structure to proposed alternatives, given the presence of high-speed algorithmic trading. It focuses on market microstructure, the detailed rules for matching buy and sell orders and determining the timing and prices at which trades occur. In the project, the researchers use experimental methods to study the three leading proposals that have emerged in recent years. The first is the investors’ exchange (IEX), whose origins are the centerpiece of Michael Lewis’ 2014 book, Flash Boys: A Revolt on Wall Street. The other proposals are more radical and not yet off the ground. FBA – Frequent Batch Auction — is a proposal by Professor Peter Cramton (University of Maryland and University of Cologne, Germany), also a CAFIN affiliate and part of the project team, along with two of his coauthors. The fully-continuous exchange (FCE) concept (see later in this article) has been developed by Professor Albert “Pete” Kyle (University of Maryland), who has done seminal work on market microstructure. The current project to compare the current format (Continuous Double auction, CDA) to the three alternatives received seed funds from CAFIN and is now being funded by the European Research Council (ERC).

The two-day workshop brought two world class scholars, Professor Kyle and Professor Axel Ockenfels (University of Cologne) to the University of California, Santa Cruz. Professor Ockenfels, Principal Investigator on the ERC grant, is a major collaborator with the UCSC group, and Professor Kyle was a guest and advisor of the research group. On the morning of March 13, the research team and the two invited scholars presented and discussed the theoretical features of the IEX (Aldrich and Friedman, 2018) and its implementation in an experimental setting. Afterwards, the programmers of UCSC’s Learning and Experimental Economics Projects (LEEPS) Laboratory presented a progress report and software-development plan for the Professor Pete Kyle experimental back-end that will support the next round of lab experiments and a public tournament that will test the three market redesign alternatives. Closing the day’s activities, Professors Kyle and Ockenfels attended and engaged with UC Santa Cruz PhD students in the market design class taught by Professor Friedman, including a proposal to implement the FCE market format in a laboratory setting.

March 14 started with Professors Aldrich and Lopez Vargas presenting their recently completed research paper (Aldrich and López Vargas, 2018), in which they test the proposed FBA format in the lab against the existing CDA format. The lab results clearly favor the FBA in terms of efficiency and price stability. Later, Professor Ockenfels, tackling another aspect of market design in non-financial contexts, presented his work on the design of the feedback system for eBay. This research provided insights into rating systems for buyers and sellers. This work may have implications for financial contracting where the reputations of transacting parties matter.

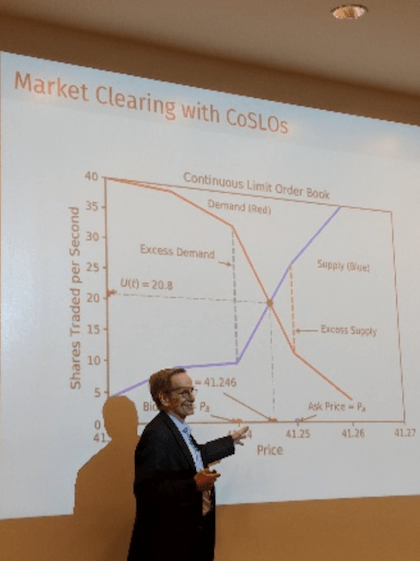

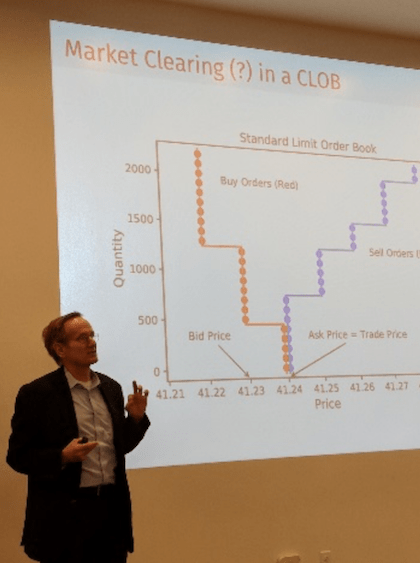

Next, for the workshop’s main event, Professor Kyle gave the Winter Quarter CAFIN lecture. He presented his groundbreaking financial market design proposal – the fully continuous exchange (FCE), alluded to earlier. While IEX seeks to slow down trading, and FBA creates periodic trading in batches, the FCE aims to smooth discreteness of prices and time intervals in trading through new forms of allocation rules. Each of the three alternatives aims to overcome the problematic incentives of the current market structure that may encourage wasteful investments in trading speed and inflate the cost of trading.

The day concluded with a wrap-up session where the CAFIN members discussed the future features of the lab experiments and the public tournament with Professors Ockenfels and Kyle. Overall, the workshop was a great success because it expanded the scope of the research program to include ultimate investors’ needs to trade and their impact on asset prices. These features will be incorporated into future test platforms for alternative financial market designs that hopefully will deliver better results to ordinary investors and to the overall economy in decades to come.

References

Aldrich, E. and Friedman, D. (2018), Order Protection through Delayed Messaging. CAFIN Working Paper 50.

Aldrich, E. and Lopez Vargas, K. (2018), Experiments in High Frequency Trading: Testing the Frequent Batch Auction. CAFIN Working Paper 51.