Welcome to CAFIN!

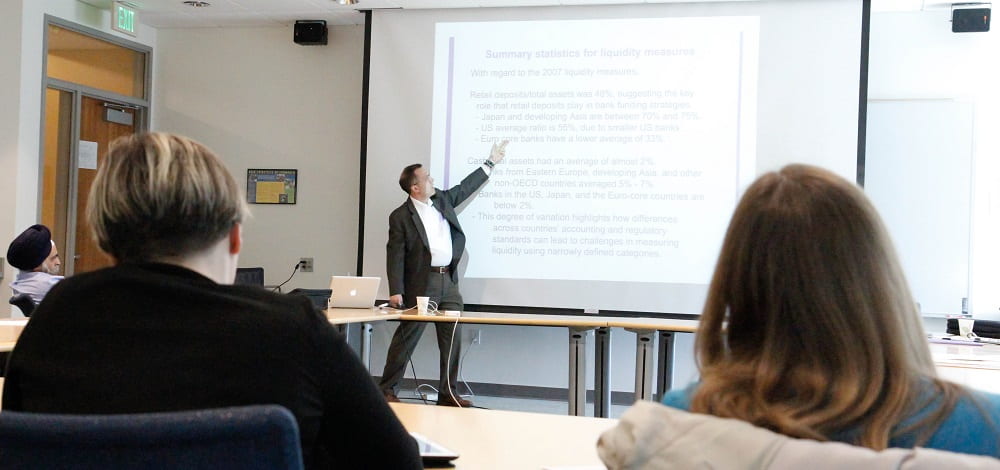

The Center for Analytical Finance (CAFIN) is a group of researchers whose aim is to solve real-world problems of finance in a globalized financial system. We seek to:

- Push the frontiers of financial knowledge

- Demystify financial markets and practitioners

- Teach modern finance in broader context to empower consumers in financial decision-making

- Show how to level the playing field, improving access to financial markets and services

- Identify problems in financial markets and how to fix them

- Bring experts from outside finance to provide context and unique skills

Research Bulletins

- Financial market solutions for funding green transition and climate resilienceClimate change is already affecting our everyday lives and mitigation and adaptation actions need to be taken now. Many technical advances have been made in climate solutions, but their implementation needs funding. On May 3, 2024, CAFIN, held a workshop that focused on the question of how we can bring more private sector funds into… Read more: Financial market solutions for funding green transition and climate resilience

- What’s Needed to Attract Private Finance of Climate Solutions?Issue 6. 06/22/2023 The Center for Analytical Finance (CAFIN), The Center for Coastal Climate Resilience (CCCR) at UC Santa Cruz (UCSC), U.C. Investments, Centre for Economic Policy (CEP), and Santa Clara University’s Leavey School of Business jointly hosted the “Catalyzing Private Financial Markets for Climate Solutions” workshop on June 9th, 2023 at Santa Clara University’s… Read more: What’s Needed to Attract Private Finance of Climate Solutions?

- SEC Proposed Rules to Enhance and Standardize Climate-Related DisclouresIssue 5. 05/04/2022 On March 21, 2022, the Securities and Exchange Commission (SEC) proposed new rules that would require publicly traded companies to disclose their climate-related financial risks. The press release and the links to the related publications are available from the SEC page. In this issue of the CAFIN bulletin, we briefly discuss the reason… Read more: SEC Proposed Rules to Enhance and Standardize Climate-Related Discloures

Featured Research

Working Paper No. 2302: Business Cycles and the Balance Sheets of the Financial and Non-financial Sectors

Author: Alonso Villacorta

Abstract: I propose and estimate a model in which bank and firm net worth influence output dynamics. Firm borrowing capacity depends on firm net worth. Banks lend to firms and use their diversified portfolio as collateral, expanding the flow of funds. Banks require net worth due to aggregate risk. Aggregate firm and bank net worth determine activity. The net worth distribution is only relevant in banking crises, in those, shocks to bank net worth have an effect beyond standard financial frictions models. A novel bank accelerator helps explain output, bank net worth, lending and spreads during the 1990, 2001, and 2008 recessions.

Link: Download Here

News & Events

- Financial market solutions for funding green transition and climate resilienceClimate change is already affecting our everyday lives and mitigation and adaptation actions need to be taken now. Many technical advances have been made in climate solutions, but their implementation needs funding. On May 3, 2024, CAFIN, held a workshop that focused on the question of how we can bring more private sector funds into… Read more: Financial market solutions for funding green transition and climate resilience

- CAFIN News April 2024CAFIN Steering Committee member Brenda Samaniego de la Parra is participating in a seminar organized by Innovations for Poverty Action (IPA) and hosted by Instituto Tecnológico Autónomo de México (ITAM) on April 18th and 19th, 2024 in Mexico City. Researchers are presenting their recent work in areas such as Environment and Climate Change, Finance and… Read more: CAFIN News April 2024